Buy Property In Sydney While Overseas Now – Amass Fortune

Buy Property In Sydney While Overseas Now – Amass Fortune

Need help to buy property in Sydney? Property buying can be tricky, especially if you live overseas. You need an experienced buyers agent who can navigate the market for you. Using a buyers agent can provide several benefits when purchasing a house.

What are Some of the Benefits of Using a buyers agent?

Local Market Knowledge

A buyer’s agent has extensive knowledge of the local housing market, including property values, trends, and neighborhoods. This can help you make an informed decision about which areas to focus on and which properties are likely to offer the best value for your money. Sometimes it even comes down to knowing which streets are better than others and what Council plans are for the specific area/s.

Access to Off-market Properties

A buyer’s agent may have access to properties that are not listed on public real estate websites or advertised to the general public. This can provide you with more options and potentially lead to finding a property that is a better fit for your needs. Further to this there are pre-market and post-market properties that your buyers agent may be privvy to or a they may go much further and door knock or letterbox drop to get you the right property.

Negotiating Power

A buyer’s agent is experienced in negotiating the best possible price and terms for a property. They can help you navigate the negotiation process and ensure that you are getting the best deal possible. Remember though, price is just one factor and sometimes the market supply and demand dynamics favour buyers and sometimes sellers. The trick is to learn everything about the vendors motivation and therefore structure the offer in the best possible light. For example the vendor may have purchased elsewhere or they may be ok with a longer settlement, it is the buyers agent job to know and use this as a factor in the negotiations.

Streamlined Process

Buying a house can be a complicated process, especially if you are unfamiliar with the local laws and regulations. A buyer’s agent can help you navigate the process for you from a distance, including arranging video inspections, organising financing, organising pest and building inspections and handling the exchange and settlement process.

Peace of Mind

Using a buyer’s agent can provide you with peace of mind, knowing that you have an experienced professional working on your behalf to find the best property at the best price. They can also help ensure that the purchase process goes smoothly and that you are not taken advantage of by unscrupulous sellers or agents.

Overall, using a buyer’s agent can be a smart investment when purchasing a house in Sydney, especially if you are from another country and unfamiliar with the local market and process.

Here’s a case study of a couple from the UK and their buying process from afar.

Case Study – UK Couple buying in Sydney

This is a hypothetical case as we’ve tried to show ALL the different steps and issues that can arise.

Photo by J carter on Pexels.com

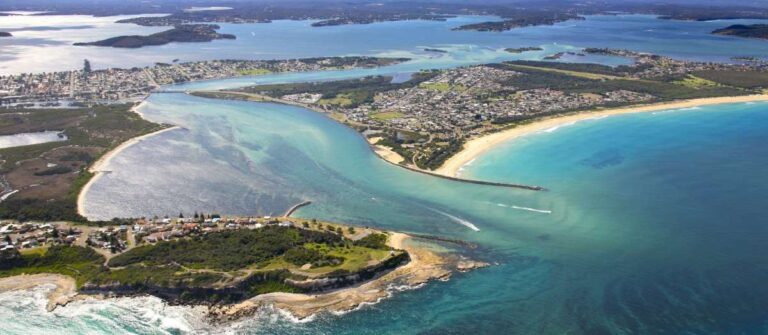

John and Sarah, a couple in their 30s from the UK, have their sights set on purchasing a home in Sydney, Australia. Both are professionals with plans to start a family within the next five years. Although they’ve never visited Sydney and lack familiarity with its housing market, they are eager to make an informed decision. With friends residing in Bondi and Freshwater, the pair finds themselves torn about where they can afford to live while maintaining the lifestyle they envision. To help with the complexities of the process, they turn to House Hunters for expert assistance.

Step 1: Determine their budget

John and Sarah sold their property in London and have £500,000 (approximately AUD $925,000) for the purchase of their new home. House Hunters Buyers Agency are engaged to determine what types of properties are available in their price range. They also consider the lifestyle opportunities in the different neighborhoods of Sydney. Without borrowing they can purchase for $925,000 including stamp duty and costs but determine via a locally referred mortgage broker that they can borrow up to $1m. This additional borrowing enables the search to broaden to more beachside suburbs in Sydney. Their maximum purchase price to $1,750,000 (leaving them with a buffer for moving and furniture expenses).

Step 2: Research the housing market

House Hunters sets off to research the local housing market and present John and Sarah with listings of different properties that meet their criteria. They drill down to what areas would be best suited for their lifestyle and interests and agree upon 2 bedroom apartments. Desired location determined between Potts Point and Bondi Beach as this is between workplace and beach.

Step 3: Search for ideal property commences

House Hunters begin a thorough on market search of properties online, they contact local agents that may have off market, pre market or post market properties. A specific selection is recommended to John and Sarah based on their personalities and desires specified in their initial brief. They are excited about two of the properties which House Hunters proceed to investigate further and for due diligence to commence. This involves market comparisons of what is currently on the market and what has recently sold. It is compared with what is happening in the marketplace with supply and demand.

Step 4: Personal Inspections and Video Inspections

House Hunters attends open house inspections on behalf of John and Sarah who then view properties online. Virtual inspections are organised via video call, and their buyers’ agent Valeria is able to walk them through the property and answer any questions they may have. House Hunters discuss the properties with the two agents who have listed these properties to identify the vendors motivations and get a gauge for the market volatility and price comparisons.

Step 5: Building and Pest Inspections

House Hunters then organises a pest and building inspection after finding a property they like, the inspections are done by a local inspector. A detailed report outlining any potential issues with the property is sent. Some vendors in New South Wales will have a pest and building inspection already available at a nominal cost. At this point it may be necessary to obtain another more detailed inspection, or it may be decided that a pest and building report is not required at all. This is dependent on the condition and the urgency of the sale.

Step 6: Make an offer

After reviewing the building inspection report and consulting with House Hunters, John and Sarah make an offer (via HH) on a property that meets their criteria. Their buyer’s agent helps them negotiate the price and terms of the sale.

Step 7: Complete the purchase

John and Sarah’s offer is made on a signed contract of sale and sign a 66W to exchange with a 10% deposit and offer a faster 4 week settlement period. This offer is accepted by the vendor. They use a local conveyancer recommended by House Hunters to handle the legal aspects of the purchase.

Overall, using House Hunters as their buyers agency helped John and Sarah navigate the complex process of buying real estate in Sydney from the UK. They were able to find a property that met their needs and budget, and complete the purchase remotely with minimal hassle.

Buy Property In Sydney

1. Can foreign investors purchase property in Sydney, and what are the regulatory requirements?

Yes, foreign investors can buy property in Sydney, but they must adhere to specific regulations. The Foreign Investment Review Board (FIRB) mandates that non-residents obtain approval before purchasing property. Typically, foreign buyers are permitted to purchase new dwellings, vacant land for development, or established properties for redevelopment purposes. Each application is assessed individually, and fees apply based on the property’s value. Consult the FIRB guidelines to understand the specific requirements and ensure compliance.

2. What financing options are available for overseas buyers looking to purchase property in Sydney?

Overseas buyers, including Australian expats and foreign investors, have access to various financing options. Australian banks and lenders offer mortgage products to non-residents, though lending criteria may be more stringent. Factors such as foreign income, exchange rates, and employment status are considered during the assessment. Engaging with a mortgage broker experienced in international clients can be beneficial in navigating these options and securing favorable terms.

3. Are there additional taxes or fees for non-resident property buyers in Sydney?

Yes, non-resident buyers may be subject to additional taxes and fees. In New South Wales, foreign purchasers are liable for a surcharge purchaser duty, which is an additional 8% on top of the standard stamp duty. Additionally, there’s a surcharge land tax applicable annually. These surcharges are in place to regulate foreign investment and support local housing affordability. Consult with a tax professional to understand the full scope of financial obligations.

4. How can overseas buyers manage the property purchasing process remotely?

Managing a property purchase from abroad requires careful planning and the assistance of local professionals. Engaging a buyer’s agent can be invaluable; they can inspect properties, negotiate on your behalf, and provide local market insights. Legal representatives, such as conveyancers or solicitors, can handle contract reviews and ensure compliance with Australian property laws. Technology facilitates virtual tours and electronic document signing, streamlining the process for remote buyers.

5. What are the implications of currency exchange and international transfers when purchasing property from overseas?

Currency exchange rates can significantly impact the overall cost of purchasing property. Fluctuations in exchange rates may affect the amount payable and the value of mortgage repayments. Consult with financial experts or use foreign exchange services to manage these risks. Some buyers opt for forward contracts to lock in favorable rates, providing certainty in financial planning. Understanding the timing and method of international fund transfers is crucial to ensure timely settlement of the property.

The complexities of purchasing property in Sydney from overseas requires thorough research and professional guidance. You need to know the regulatory environment, financing options, tax implications, and logistical considerations, you can make informed decisions and successfully acquire property in Sydney.