House Prices Mosman: A Comprehensive Analysis

If you’re considering investing in the thriving real estate market of Mosman, then 2024 may be the perfect time to make your move. But what is the average house price Mosman, or the factors that make Mosman so unique? Is it a great place to invest, and what to expect in 2024. This is based on data extrapolated from leading economists and property analysts.

Overview of the Mosman Property Market in 2023

Before we delve into the future, let’s first understand the current status of the Mosman property market. According to CoreLogic, in 2023, the Sydney property market, including Mosman, experienced a resurgence with prices rising consistently over ten months. This growth is primarily attributable to a combination of factors including low inventory levels, a robust rental market, and a surge in net overseas migration.

House Prices In Mosman

In October, 2023 Mosman had 189 properties available for rent and 164 properties for sale. The mosman median hosue price over 2023 range from $4,999,850 for houses to $1,210,000 for units. If you are looking for an investment property, consider houses in Mosman rent out for $1,990 PW with an annual rental yield of 2.3% and units rent for $695 PW with a rental yield of 3.3%.

Based on five years of sales, Mosman has seen a compound growth rate of 4.2% for houses and -8.2% for units.

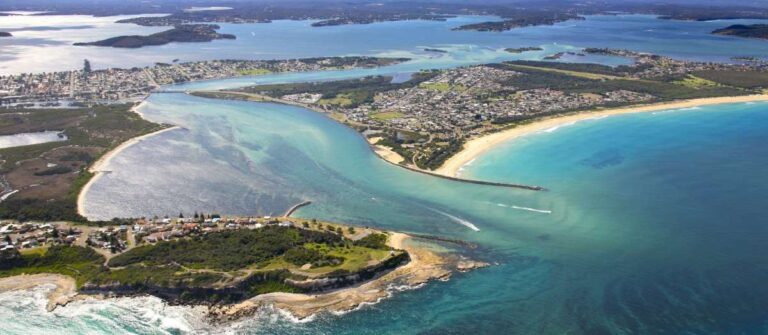

The Unique Charm of Mosman

Mosman, a suburb located on the Lower North Shore of Sydney, stands out for its unique lifestyle and economic benefits. Its picturesque coastal vistas, coupled with its proximity to the city, have made it a hotbed for property investors and homeowners alike. The area’s high-quality schools, local amenities, and vibrant community further contribute to its appeal.

The Role of Migration and Population Growth

Mosman’s property market has been significantly impacted by migration and population growth trends. The suburb has seen a steady influx of migrants drawn by its lifestyle and job opportunities. Moreover, Sydney’s overall population growth, projected to reach 8 million by mid-century, is expected to create further demand for housing in suburbs like Mosman.

The Impact of Interest Rates and Economic Factors

The Reserve Bank of Australia’s (RBA) monetary policy decisions have played a crucial role in shaping the property market. For instance, the rise in interest rates through 2022 and 2023 has affected property prices and buyer behaviour. However, with expected rate cuts in late 2024, the market dynamics are likely to shift, potentially igniting a resurgence in property sales.

The Inventory Crunch and its Implications

One of the key drivers of property prices in Mosman is the persistently low inventory levels. The shortage of available properties for sale has led to a seller’s market, with demand often outstripping supply. This inventory crunch is likely to continue into 2024 unless there’s a significant increase in new property listings or a slowdown in buyer activity.

The Role of Home Construction

The rate of new home construction in Sydney, and particularly in suburbs like Mosman, could play a crucial role in the 2024 property market. A surge in new constructions could help alleviate the current inventory crunch, potentially stabilizing prices. However, this is contingent on various factors ranging from regulatory approvals to market demand for new properties.

Housing Affordability in Mosman

Despite the high property prices, Mosman’s housing market continues to attract investors and homebuyers due to its long-term investment potential. The suburb’s strong capital growth record, coupled with its lifestyle benefits, outweighs the immediate affordability concerns for many property buyers. This trend is likely to persist into 2024, keeping the momentum in the property market.

The Rental Market Outlook for Mosman

Mosman’s rental market has remained robust, characterized by high rental yields and low vacancy rates. The surge in net overseas migration, coupled with a lack of available rental properties, has led to a buoyant rental market. This scenario is likely to continue into 2024, making investment in rental properties in Mosman a lucrative option.

The Impact of Economic Uncertainties

While the outlook for Mosman’s property market remains optimistic, potential economic uncertainties could impact market dynamics. Factors such as inflation, employment trends, and global economic conditions could influence buyer sentiment and market activity in 2024.

Predicted House Price Growth for Mosman in 2024

Based on the current trends and expert forecasts, house prices in Mosman are expected to continue their upward trajectory in 2024. While the rate of growth may moderate compared to previous years, positive price growth is still anticipated. This prediction is supported by the sustained demand for properties, low inventory levels, and the anticipated economic recovery.

Mosman is a Great Place to Invest

Mosman’s robust property market, strong capital growth record, and high rental yields make it a great place to invest. Additionally, its unique lifestyle attractions and economic prospects enhance its appeal as an investment destination. Therefore, investing in Mosman’s property market in 2024 could offer strong returns in the long run.

Navigating the 2024 Mosman Property Market

While the future of the property market always carries a degree of uncertainty, Mosman’s market shows promising prospects for 2024. By keeping an eye on market trends, economic indicators, and expert forecasts, investors and homebuyers can navigate the 2024 property market in Mosman with confidence and make informed decisions.

Regardless of market conditions, the timeless charm and unique appeal of Mosman make it a desirable destination for property investment. Whether you’re a seasoned investor or a first-time homebuyer, the Mosman property market presents a wealth of opportunities that are worth exploring in 2024 and beyond.