Yield Vs Capital Growth – A Buyers Guide

Yield Vs Capital Growth – A Buyers Guide

Investing in property is one of the most popular ways Australians build wealth, but deciding on the right strategy can be daunting. Should you prioritize high rental yield for steady cash flow or aim for capital growth to build long-term wealth?

This guide is here to help you weigh up these options with expert insights from Valeria Davis, a trusted Sydney-based property expert from House Hunters. With decades of experience guiding buyers through Australia’s ever-changing property market, Valeria has seen firsthand how these strategies can make or break investment success.

Having helped hundreds of clients secure the best investments in Sydney’s competitive market, Valeria brings practical advice tailored to your needs. This guide will empower you with the knowledge to make informed decisions, whether you’re buying your first investment property or adding to your portfolio.

Understanding Rental Yield

Rental yield measures the return on investment (ROI) from rental income. It’s a percentage that reflects how much a property earns relative to its purchase price. Investors who prioritise rental yield often seek properties that generate consistent cash flow.

Types of Rental Yield

- Gross Rental Yield – The total income earned annually as a percentage of the property’s purchase price. It excludes expenses like maintenance and taxes.

- Net Rental Yield – A more precise measure that deducts property-related expenses from rental income. This gives a clearer picture of your actual returns.

How to Calculate Rental Yield

Let’s say you purchase a property for $500,000, and it earns $25,000 annually in rent:

- Gross Rental Yield: ($25,000 ÷ $500,000) × 100 = 5%

For net rental yield, you’ll subtract expenses (e.g., $5,000): - Net Rental Yield: (($25,000 – $5,000) ÷ $500,000) × 100 = 4%

Factors Influencing Rental Yield

- Location – Suburbs with high rental demand typically offer better yields. Proximity to universities, transport, and amenities plays a big role.

- Property Type – Apartments often have higher yields compared to houses due to lower purchase prices and steady rental demand.

- Market Conditions – High vacancy rates or economic downturns can impact rental income.

Understanding Capital Growth

Capital growth refers to the increase in a property’s value over time. This strategy focuses on properties that appreciate in value, providing a solid return when sold. For many investors, capital growth is the key to building long-term wealth.

How Capital Growth Works

If you purchase a property for $500,000 and its value increases to $600,000 in five years, your capital growth is $100,000. This profit comes from rising property prices, driven by factors like infrastructure development and population growth.

Why Capital Growth Matters

Capital growth doesn’t just provide financial gains—it also increases your borrowing capacity. As the property’s value rises, so does your equity, enabling you to invest in additional properties or other ventures.

Factors Influencing Capital Growth

- Economic Conditions – A strong economy with job opportunities and infrastructure investments attracts more buyers, driving up prices.

- Location – Areas with limited supply and high demand tend to experience stronger growth. Established suburbs with good schools and amenities are prime candidates.

- Market Trends – Government policies, interest rates, and population shifts can significantly affect capital growth potential.

Comparing Yield and Capital Growth

Choosing between rental yield and capital growth depends on your financial goals and investment strategy. Understanding the key differences and trade-offs can help you make an informed decision.

Key Differences

- Rental Yield: Provides a steady income stream, ideal for investors seeking cash flow to cover expenses or support their lifestyle.

- Capital Growth: Builds wealth over the long term, appealing to investors who can afford to wait for value appreciation.

Pros and Cons of Rental Yield

Pros:

- Consistent income stream.

- Lower risk during market downturns if demand for rentals remains steady.

- Can help cover mortgage repayments and maintenance costs.

Cons:

- May not provide significant long-term wealth.

- Income might fluctuate with changes in vacancy rates or rental demand.

- High-yield properties are often in areas with limited capital growth potential.

Pros and Cons of Capital Growth

Pros:

- Significant wealth accumulation over time.

- Increased equity allows for reinvestment in other properties.

- Properties in high-growth areas often attract premium renters.

Cons:

- Income is delayed until the property is sold.

- Higher purchase prices can mean greater upfront costs and debt.

- Relying on market appreciation involves more risk.

Case Studies

- High-Yield Property in Regional NSW:

A $400,000 property with a 6% gross rental yield provides a steady $24,000 annual income. However, capital growth over five years is only 1.5%. - High-Growth Property in Sydney:

A $1,000,000 home in an emerging suburb grows in value by 6% annually, adding $60,000 each year to its worth. Rental yield is just 3%, providing $30,000 annually.

Investor Profiles: Which Strategy Suits You?

Choosing between yield and growth depends largely on your financial goals, life stage, and risk tolerance.

Short-Term Income Needs

If you need regular cash flow to cover living expenses, rental yield is the better choice. Retirees or those looking for a secondary income often favour high-yield properties.

Long-Term Wealth Accumulation

Investors who can hold onto properties for several years without requiring immediate returns benefit most from capital growth. Younger professionals or those with stable primary incomes often lean toward this strategy.

Life Stage and Financial Goals

- Early Career: Focus on capital growth to build wealth over time.

- Mid-Career: Balance yield and growth to diversify your portfolio.

- Retirement: Prioritize high-yield properties for steady income.

Risk Tolerance

Investors with low risk tolerance may prefer properties with steady rental demand and predictable yields. Those willing to take on more risk for higher returns might target growth-focused areas with potential market appreciation.

Market Analysis: Australian Property Trends

The Australian property market has seen significant changes over the years, with trends varying between cities and regions. Understanding these patterns can help investors choose between rental yield and capital growth.

Historical Performance of Rental Yields

Rental yields in Australia tend to be higher in regional areas compared to metropolitan hubs. For example:

- Regional NSW often offers yields above 5%, attracting investors seeking cash flow.

- Major cities like Sydney and Melbourne typically deliver yields below 4%, reflecting higher property prices.

Historical Performance of Capital Growth

Capital growth has traditionally been stronger in metropolitan areas.

- Over the past 20 years, Sydney and Melbourne have consistently outperformed other cities, with average annual growth rates of 6-8%.

- Regional areas often lag in capital growth, though they may show spikes due to lifestyle shifts or infrastructure developments.

Current Market Trends and Projections

- Rental Yields: The recent surge in demand for regional living has boosted yields in areas like the Central Coast and Gold Coast.

- Capital Growth: Infrastructure projects, like Sydney’s WestConnex, continue to drive growth in nearby suburbs.

- Economic uncertainties and interest rate fluctuations may slow growth temporarily but create buying opportunities.

Economic Policies and Interest Rates

Government incentives for first-home buyers and low interest rates have historically supported growth. Recent rate hikes have cooled some high-growth markets, making rental yield strategies more appealing in the short term.

The Role of Location in Investment Decisions

Location is arguably the most critical factor in determining whether a property will deliver strong yield, growth, or both.

High-Yield Suburbs vs. High-Growth Suburbs

- High-Yield Suburbs: Often found in regional areas or outer suburbs. Example: Newcastle in NSW or Logan in Queensland.

- High-Growth Suburbs: Typically located in inner-city areas or suburbs undergoing gentrification. Example: Marrickville in Sydney or Richmond in Melbourne.

Regional vs. Metropolitan Areas

- Regional Areas: Lower property prices and higher yields make them attractive to cash-flow-focused investors. However, growth can be inconsistent.

- Metropolitan Areas: Higher prices often lead to lower yields, but strong population growth and infrastructure investment drive long-term capital growth.

Key Location Factors

- Amenities and Infrastructure: Properties near schools, hospitals, and transport hubs tend to attract more renters and buyers.

- Employment Opportunities: Proximity to major employment centres boosts demand and capital growth potential.

- Population Growth: Rapidly growing areas, like Western Sydney, offer opportunities for both yield and growth.

Property Types: Yield and Growth Potential

The type of property you choose—house, apartment, or other options—can significantly affect your investment’s rental yield and capital growth potential.

Houses vs. Apartments

- Houses: Generally offer higher capital growth due to land value. Buyers often pay a premium for larger blocks in sought-after suburbs. However, rental yields can be lower as house rents don’t always keep pace with purchase prices.

- Apartments: Typically provide better rental yields because they cost less to buy while maintaining steady rental demand. However, capital growth may be limited, particularly for newer builds or those in oversupplied areas.

New Developments vs. Established Properties

- New Developments: Often attract strong tenant demand due to modern features. However, they may carry risks such as developer mark-ups or slow initial capital growth.

- Established Properties: These often appreciate more steadily over time, especially in established suburbs with character homes. Buyers can also add value through renovations or extensions.

Impact of Property Features

- Number of Bedrooms: Two-bedroom properties often hit the sweet spot for renters and buyers, balancing affordability with functionality.

- Outdoor Space: Balconies, courtyards, or backyards are increasingly sought after, especially post-pandemic.

- Proximity to Amenities: Walkability to shops, parks, and schools boosts both yield and growth potential.

Financing Your Investment

Your financing strategy is crucial in determining the success of your property investment. The right loan can enhance your returns and support your chosen strategy.

Loan Types for Investment Strategies

- Interest-Only Loans: Popular with yield-focused investors as they reduce monthly repayments, improving cash flow. However, they don’t reduce the principal.

- Principal and Interest Loans: Preferred for capital growth strategies, as they build equity faster and reduce total interest over time.

Impact of Interest Rates on Investment Returns

Higher interest rates can erode rental yield, making it essential to factor them into your calculations. Locking in fixed rates can provide stability, while variable rates might offer flexibility in a falling market.

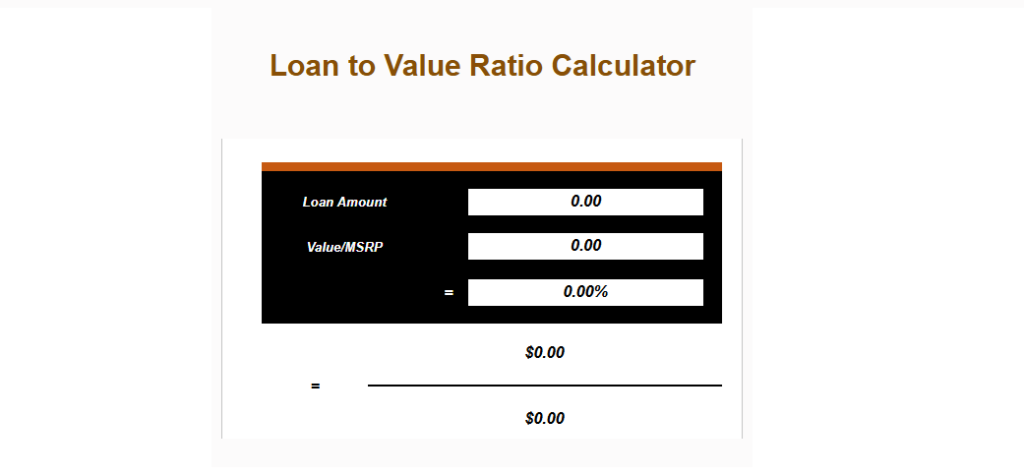

Loan-to-Value Ratio (LVR) and Deposit Size

- A lower LVR (e.g., 70%) reduces risk but requires a larger deposit.

- A higher LVR (e.g., 90%) allows you to enter the market sooner but increases repayments and lender’s mortgage insurance costs.

Expert Tip from Valeria Davis

“Always align your financing with your investment goals. If you’re unsure, consulting a mortgage broker or buyer’s agent can help you structure your loan for success.”

Tax Implications

Understanding the tax implications of your investment strategy is essential for maximizing returns.

Tax Benefits Associated with Rental Income

- Rental property expenses, such as maintenance and property management fees, can be deducted from taxable income.

- Depreciation of assets, like appliances and fittings, offers additional deductions.

Capital Gains Tax (CGT) Considerations

- Properties held for more than 12 months qualify for a 50% CGT discount when sold.

- High-growth properties may attract significant CGT, so careful planning is necessary to minimize liabilities.

Negative Gearing: Advantages and Risks

- Advantages: Negative gearing allows investors to offset rental income losses against other taxable income, reducing their tax bill.

- Risks: Over-reliance on negative gearing can strain finances if rental income or market conditions decline.

Pro Tip

“Work closely with an accountant or financial advisor to understand how taxes will affect your returns. Every investor’s situation is different.”

Risks and Challenges

Investing in property, whether focusing on yield or capital growth, comes with inherent risks. Understanding these challenges can help you develop strategies to mitigate them and protect your investment.

Market Volatility

Property markets can fluctuate due to economic changes, interest rate shifts, or government policies. A downturn could impact capital growth-focused investments, leading to longer hold times before seeing returns.

Vacancy Risks

For yield-focused investors, vacancy periods can severely affect cash flow. Properties in areas with high competition or seasonal demand are particularly vulnerable. Choosing locations with stable rental demand minimizes this risk.

Maintenance and Unexpected Costs

Properties, especially older ones, may require unexpected repairs or upgrades. These costs can erode both yield and growth potential. Regular inspections and a maintenance fund can help manage these expenses.

Mitigating Risks

- Diversify your portfolio to spread risk between different locations and property types.

- Ensure a financial buffer for emergencies, such as a few months of mortgage repayments and property expenses.

- Conduct thorough research or work with professionals like buyer’s agents to make well-informed decisions.

Tips from Valeria Davis, House Hunters

Drawing from her extensive experience as a buyer’s agent, Valeria Davis shares practical tips for navigating the Australian property market:

Do Thorough Research

“Investing in property isn’t just about location—it’s about understanding the market. Study past trends, vacancy rates, and planned developments in your chosen area.”

Leverage Local Knowledge

“Working with a buyer’s agent gives you an insider’s perspective. We know the hidden gems in Sydney and the surrounding regions where both yield and growth potential align.”

Don’t Neglect Due Diligence

“Always inspect the property thoroughly, check the strata reports (for apartments), and understand any potential legal or zoning restrictions.”

Valeria’s Anecdote

“One of my clients wanted a high-yield property and was eyeing a unit near Sydney’s CBD. While the yield was promising, my analysis showed limited growth potential. Instead, I found them a townhouse in an emerging suburb. It had a slightly lower yield but appreciated by 12% within two years—balancing their goals perfectly!”

Benefits of a Buyer’s Agent

A professional buyer’s agent saves you time, ensures you avoid common pitfalls, and uses their expertise to negotiate the best deal. With access to off-market properties, they can also uncover opportunities most buyers never see.

Making the Decision: Yield, Growth, or Both?

Choosing between rental yield and capital growth—or a combination of both—depends on your unique circumstances and goals.

Evaluate Your Financial Situation

Take stock of your current income, expenses, and savings. If cash flow is tight, a high-yield property may offer immediate relief. Conversely, those with financial stability can aim for long-term growth.

Diversify Your Portfolio

A balanced portfolio can mitigate risks. For example, combining a high-yield property in a regional area with a high-growth property in a metropolitan suburb provides steady income and wealth accumulation.

Plan for the Long Term

Think about your exit strategy. Will you hold the property for decades, or is it part of a shorter-term plan to build equity for another investment? A clear strategy ensures your investments align with your goals.

Seek Professional Guidance

Working with professionals like buyer’s agents, mortgage brokers, and accountants can simplify your decision-making. They bring expertise to the table and help tailor solutions to your specific needs.

A Word From Valerie Davis

As someone who has spent years guiding buyers through the complexities of the Sydney property market, I’ve seen how choosing between yield and capital growth can be life-changing. There’s no one-size-fits-all approach—it’s all about aligning your strategy with your goals.

For example, I recently worked with a young couple looking to build a property portfolio. They were torn between high-yield properties in Newcastle and growth-focused homes in Sydney. After understanding their income, risk tolerance, and long-term plans, we secured a growth-focused property in an up-and-coming Sydney suburb. Within two years, they had enough equity to buy a high-yield property, balancing their portfolio perfectly.

Having a buyer’s agent on your side makes all the difference. With our expertise, we help clients avoid costly mistakes, find the best opportunities, and stay focused on their goals. If you’re weighing up yield vs. capital growth, consider what’s most important for your situation—and don’t hesitate to seek professional advice.